Most discussions of industrial policy in the U.S. focus on semiconductors, batteries, or electric vehicles. But there’s an incredibly important industry where the U.S. has fallen badly behind , and where its deficiencies could cost the U.S. Military its edge over China. I’m talking about drones .

关于美国产业政策的讨论大多集中在半导体、电池或电动汽车领域。但有一个极其重要的产业 ,美国已经严重落后, 其缺陷可能使美国军方失去对中国的优势—— 无人机 。

I’ve been banging the drum for a decade about the crucial importance of drones for modern warfare, but I’m no expert in the field. So I got Cat Orman and Jason Lu , the cofounders of Flyby Robotics — a startup developing American-made drones — to write me a guest post on the topic. It’s important stuff.

十年来, 我一直在鼓吹 无人机对现代战争的至关重要性,但我并不是这方面的专家。因此,我邀请 Flyby Robotics (一家美国无人机初创公司) 的 联合创始人 凯特-奥曼(Cat Orman) 和 杰森-卢(Jason Lu)为 我撰写一篇关于这个话题的文章。

Financial disclosure: I have no financial stake in Flyby Robotics, or in any related company or fund.

财务披露:我在 Flyby Robotics 公司、任何相关公司或基金中都没有经济利益。

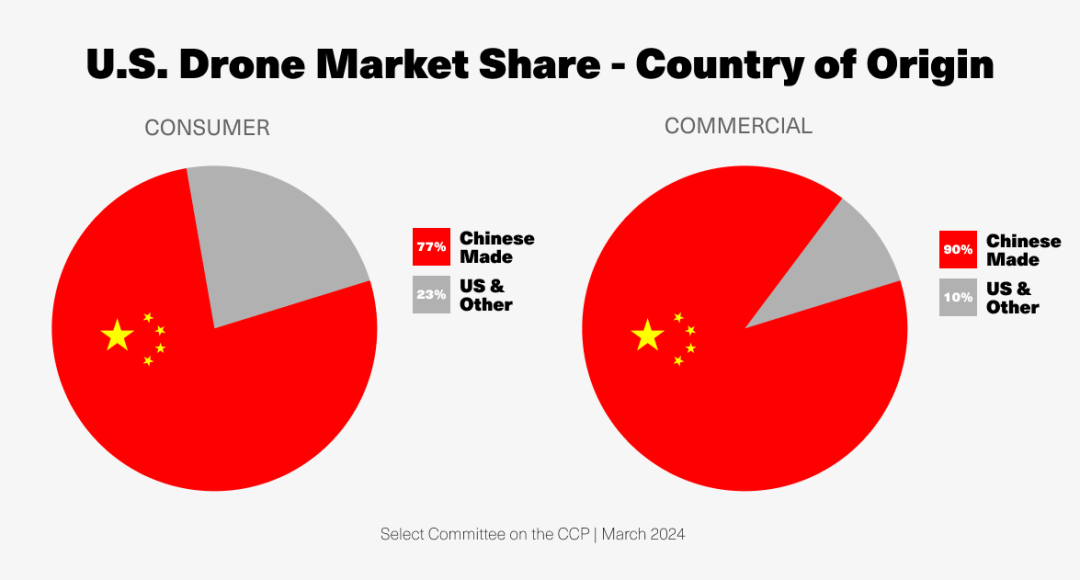

Last month, the House of Representatives passed a bill that would ground over 70% of America’s industrial drone fleet. The Countering CCP Drones Act seeks to ban DJI, a Chinese unicorn and the world’s largest commercial drone manufacturer, from supplying its drones in the United States. So why has the bill sent drone pilots into a panic? Here is the unfortunate truth: there is no real alternative to DJI .

上个月,众议院 通过了一项法案 ,将禁 飞 美国 70% 以上 的 工业无人机。 旨在禁止中国独角兽企业、全球最大的商用无人机制造商大疆创新(DJI)在美国供应无人机。那么,为什么该法案会让无人机飞行员陷入恐慌呢? 一个 不幸的事实是: 大疆无人机没有替代品 。

Like much of our electronics, the majority of drones deployed in the United States are made in China. It’s a bigger hole in our industrial base than you might think. Drones operate behind the scenes of every American industry — they inspect our civil infrastructure and electric grid, shoot movies, conduct land surveys, detect diseases in crops, prospect for minerals, locate gas leaks, and create 3D models. If you get mugged in one of over 1,500 American police precincts (including Santa Monica, where I live), the first responder on the scene might be a drone. But — as the war in Ukraine has demonstrated — even commercial-grade drones will play an increasingly important role in national security. To protect our critical industries and field an effective fighting force, the United States must develop a competitive drone industry, then get DJI out of our airspace.

与我们的大部分电子产品一样,在美国部署的大部分无人机都是中国制造的。这在我们的工业基础上是一个比你想象中更大的漏洞。无人机在美国各行各业的幕后运作–它们检查我们的民用基础设施和电网、拍摄电影、进行土地勘测、检测农作物病害、勘探矿产、定位天然气泄漏以及创建 3D 模型。如果你在 美国1500 多个 警察分局 (包括我居住的圣莫尼卡) 中的一个 分局 被抢劫 , 现场的第一反应可能就是无人机。但是,正如乌克兰战争所证明的那样,即使是商用级无人机也将在国家安全中发挥越来越重要的作用。为了保护我们的关键产业和有效的战斗力,美国必须发展有竞争力的无人机产业,然后将大疆赶出我们的领空。

|

A Brief History of Unmanned Aircraft Systems (UAS) |

无人驾驶航空器系统(UAS)简史

The Countering CCP Drones Act was prompted by concerns that Chinese-made drones could be used to leak data on our critical infrastructure vulnerabilities back to a foreign adversary. DJI has already been accused of sending sensitive information to the Chinese Communist Party (CCP). According to the FBI , the use of DJI drones “risks exposing sensitive information to PRC authorities [and] jeopardizing U.S. national security”. As tensions with China rise, we cannot afford this vulnerability — both a serious cybersecurity risk to our critical industries and a commercial dependency that could be cut off at any time.

由于担心中国制造的无人机可能被用来向外国对手泄露我们关键基础设施漏洞的数据,《法案》应运而生。 大疆创新 已被指控 向中国 发送敏感信息 。据 联邦调查局称 ,使用大疆无人机 “有可能将敏感信息泄露给中国,并危及美国国家安全”。随着与中国紧张关系的加剧,我们无法承受这种脆弱性–这既是对我们关键产业的严重网络安全风险,也是随时可能被切断的商业依赖。

So why hasn’t the United States developed its own drone industry?

那么,为什么美国没有发展自己的无人机产业呢?

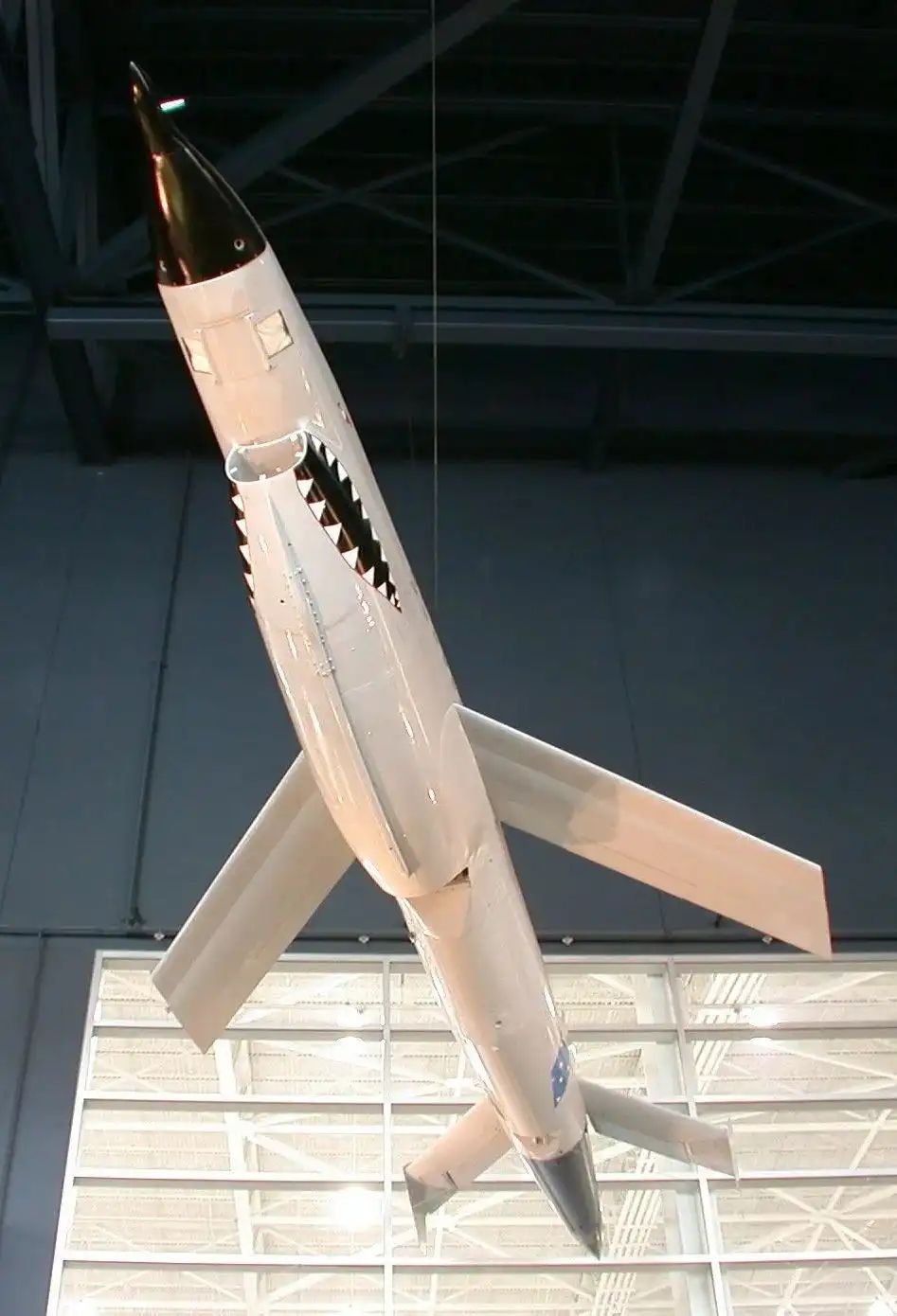

It’s a little-known fact that the United States pioneered the use of drones in the mid-20th century, first as target practice for the Army in the 1940s, then for photographic reconnaissance in Vietnam . American primes General Atomics and Northrop Grumman have dominated multimillion-dollar long-endurance systems like the Predator and Global Hawk since they were deployed over Bosnia in the 1990s. But when drones evolved from eight-figure military jets to commercial quadcopters, the United States lost its edge.

一个鲜为人知的事实是,美国早在 20 世纪中叶就率先使用了无人机,先是在 20 世纪 40 年代 作为 陆军的 目标练习 ,然后 在越南 用于 摄影侦察 。 自 20 世纪 90 年代 “捕食者” 和 “全球鹰” 等价值数百万美元的长航 时系统被部署到波斯尼亚上空 以来 , 美国的主要公司通用原子 公司(General Atomics ) 和 诺斯罗普-格鲁曼公司(Northrop Grumman)一直主导着这些系统 。 但当无人机从价值八位数的军用喷气机发展到商用四旋翼无人机时,美国失去了优势。

Plane-launched Firebee target drone, circa 1950s 飞机发射的 “火蜂 “目标无人机,大约在 20 世纪 50 年代 Plane-launched Firebee target drone, circa 1950s 飞机发射的 “火蜂 “目标无人机,大约在 20 世纪 50 年代 |

Vietnam-Era Model 147 recon drone 越战时期的 147 型侦察无人机 Vietnam-Era Model 147 recon drone 越战时期的 147 型侦察无人机 |

MQ-1 Predator MQ-1 捕食者 MQ-1 Predator MQ-1 捕食者 |

A decade ago, the commercialization of this military technology was a promising capability of the future. “Consumer” drones were largely targeted towards hobbyists with home-assembly kits, and dedicated startups were just gaining traction. In 2010, Parrot, a French electronics company, debuted the AR.Drone , the first-ever smartphone-controlled system, at CES . In 2014, 3D Robotics (3DR), founded five years earlier by a 20 year old tinkerer and the editor-in-chief of Wired , released the Iris+ and the X8 Android-controlled quadcopters aimed for hobbyists with GoPros. But these drones were effectively toys. They couldn’t reliably produce quality video, even by consumer standards, and they were nearly impossible for the average person to fly. With no ability to maintain a stable position, even a slight breeze could render footage unusable. With crash landings so frequent, systems couldn’t make the leap to mass-market.

十年前,这项军事技术的商业化还是一项前景广阔的未来能力。当时,”消费级 “无人机主要面向使用家庭组装套件的业余爱好者,而专门的初创公司才刚刚起步。2010 年,法国电子公司 Parrot 在 CES 上 首次推出了 AR.Drone, 这是有史以来第一款由智能手机控制的系统 。2014 年, 3D Robotics公司 (3DR) 发布了Iris+ 和 X8 安卓控制的四旋翼无人机,面向拥有 GoPros 的业余爱好者。但这些无人机实际上只是玩具。即使按照消费者的标准,它们也不能可靠地制作高质量的视频,而且普通人几乎不可能驾驶它们。由于无法保持稳定的位置,哪怕是一阵微风都可能导致无法拍摄。由于坠落事故频发,该系统无法进入大众市场。

The king of the consumer drone market was made in 2013, when DJI released its flagship product. Founded in 2006 by Frank Wang in a Hong Kong University of Science and Technology dorm room, DJI had released a couple of hobbyist quadcopters, but the Phantom 1 was its breakout hit. A $629 dinner plate-sized drone with four motors arranged in a distinctive white body, the Phantom had the stability to take professional-quality footage every time, and required little to no training to pilot it successfully. The drone market ballooned from a small community of nerds to anyone who wanted to shoot personal footage, or even professional film. It was an inflection point — suddenly, drones had real consumer utility.

消费级无人机市场的王者诞生于 2013 年,当时大疆创新(DJI)发布了其旗舰产品。 大疆 创新 由 Frank Wang 于 2006 年 在香港科技大学的一间宿舍里 创立 ,曾推出过几款业余爱好者四旋翼无人机,但 Phantom 1 是它的爆款。Phantom 1 是一款售价 629 美元的餐盘大小的无人机,在独特的白色机身中装有四个马达,其稳定性使其每次都能拍摄出专业品质的镜头,而且几乎不需要任何培训就能成功驾驶。无人机市场从书呆子的小圈子膨胀到任何想拍摄个人镜头甚至专业电影的人。这是一个拐点–突然之间,无人机有了真正的消费用途。

A DJI Phantom (Source: Flickr) 大疆 Phantom(图片来源:Flickr Flickr) A DJI Phantom (Source: Flickr) 大疆 Phantom(图片来源:Flickr Flickr) |

Frank Wang was obsessed with hardware, and the Phantom 1 was in a class of its own. DJI crafted custom components, from motors and gimbals to advanced avionics ensuring that everything the customer cared about was in their control. DJI got three things right:

Frank Wang 对硬件非常痴迷,Phantom 1 就是其中的佼佼者。从电机、云台到先进的航空电子设备,大疆创新都为客户量身定制,确保客户所关心的一切都在他们的掌控之中。大疆创新做对了三件事:

- Reliability : the failure rate was extremely low.

可靠性 :故障率极低 。 - Video transmission : users got crisp 1080p video even at a distance of about 1000’. Gamechanger.

视频传输 :即使距离约 1000 英尺,用户也能获得清晰的 1080p 视频 。 改变游戏规则。 - User experience : extremely easy to fly.

用户体验 :极易驾驶。

Two years after the Phantom hit the market, the first American competitor came out. 3D Robotics released its 3DR Solo , marketed as the first “smart drone” and priced at $999.95. But competing with China in a sub-$1,000 market is a losing game — labor and component costs in Shenzhen are simply unmatched elsewhere. Solo reduced its price to $799.95 a year in, but couldn’t keep up with the $629 Phantom.

Phantom 上市两年后,第一个美国竞争者出现了。3D Robotics公司发布了 3DR Solo ,号称第一款 “智能无人机”,售价999.95美元。但是,在低于 1000 美元的市场上与中国竞争是一场失败的游戏–深圳的劳动力和零部件成本是其他地方无法比拟的。Solo 在 一年前 将价格 降至 799.95 美元,但仍赶不上售价 629 美元的 Phantom。

|

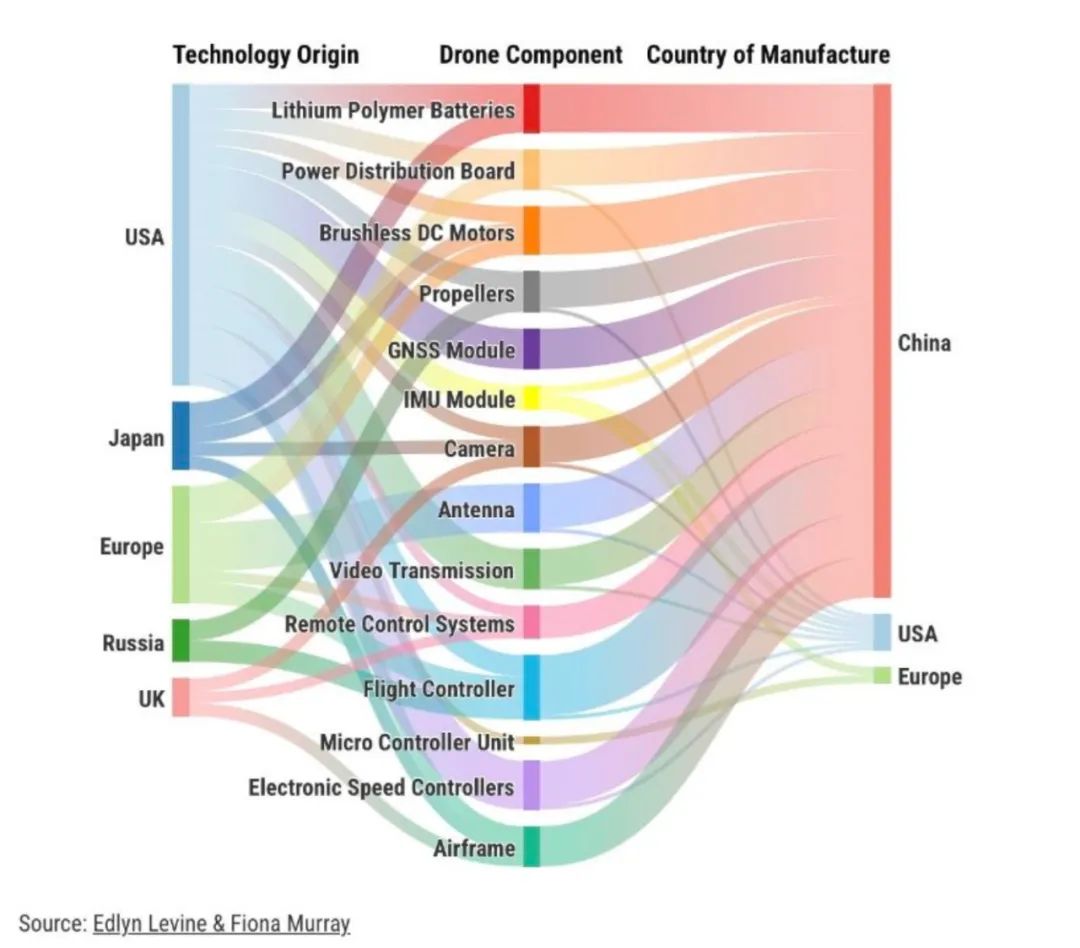

Most drone components were invented in the U.S., Japan, and Europe, but are now almost all made in China. (h/t @RayWangTaiwan

大多数无人机部件都是在美国、日本和欧洲发明的,但现在几乎都在中国制造。(h/t @王雷台湾 )

That same month, DJI would receive another unfair advantage. On May 19th, the State Council announced Made in China 2025 , a ten-year action plan designed to make the nation a manufacturing superpower. The plan focused on developing China’s industrial base, transitioning from the world’s factory of cheap, low-quality goods into a leader in high-tech manufacturing. Alongside BYD, Huawei, and Autel, DJI was named a champion of the initiative. Through Made in China 2025, the PRC earmarked hundreds of billions in funding to build up advanced technology companies. Leveraging these subsidies, DJI and Autel, another Chinese drone manufacturer, were able to artificially cut prices to dump cheap systems on the American market . The United States, in observation of a free and competitive international marketplace, did not match these subsidies; American drone companies struggled to survive.

同月,大疆创新(DJI)又获得了一个不公平的优势。5 月 19 日,国务院公布了 《中国制造 2025》 ,这是一项旨在使中国成为制造业超级大国的十年行动计划。该计划的重点是发展中国的工业基础,从世界廉价低质商品的制造工厂转变为高科技制造业的领导者。大疆创新与比亚迪、华为和 Autel 一起被评为该计划的倡导者。通过《中国制造 2025》,中国划拨了 数千亿 资金用于建设先进技术公司。利用这些补贴,大疆和另一家中国无人机制造商欧特尔(Autel)得以人为降价 ,向美国市场倾销廉价系统 。美国遵守自由竞争的国际市场规则,没有匹配这些补贴;美国无人机公司艰难地生存着。

Notably, not all of DJI’s funding came from the Chinese government. Foolishly, in retrospect, the growth of the Chinese drone industry was, in part, fueled by American venture capital . In 2014 and 2015, Sequoia and Accel made major investments in DJI, collectively exceeding any funding for 3DR, Airware, or any other American drone manufacturers. With CCP subsidies and American capital, DJI would continue to dominate the global market. Naturally, a mass-extinction event for U.S. companies followed. In 2016, 3D Robotics shut down its drone manufacturing business line, and Airware, a leading American enterprise drone manufacturer, closed its doors in 2018.

值得注意的是,大疆创新的资金并非全部来自中国政府。 现在 回过头来看,中国无人机行业的发展在一定程度上 受到了美国风险投资的助推 。2014 年和 2015 年,红杉和 Accel 对大疆 进行了重大 投资 ,合计超过了对 3DR、Airware 或任何其他美国无人机制造商 的 投资 。在中共的补贴和美国资本的支持下,大疆将继续主导全球市场。自然而然,美国公司的集体灭亡事件接踵而至。2016 年,3D Robotics 关闭了 无人机制造业务线, 2018 年 , 美国领先的企业级无人机制造商 Airware 也 关门大吉。

However, one American company was lucky enough to enter the market just after this bloodbath. Skydio , founded in 2014, sought to build and deploy drones for enterprises, not consumers. Critically, like DJI, the founders of Skydio were hardware-obsessed, prioritizing reliability and user experience. They launched their first product, the $2,499 R1 , in February of 2018. Just years earlier, there was no enterprise market to speak of — use cases had been discussed, but there was still a large gap in educating end-users on what drones could do for their business. By 2018, experienced drone operators had begun to connect the dots; roof inspection, land surveying, and search and rescue were all early use cases. In fact, commercial awareness grew so much that when the Skydio 2 launched in 2016, it was an immediate hit.

然而,有一家美国公司却幸运地在这场血雨腥风之后进入了市场。 Skydio 成立于 2014 年,旨在为企业而非消费者制造和部署无人机。至关重要的是,与大疆一样,Skydio 的创始人也对硬件情有独钟,将可靠性和用户体验放在首位。他们 于 2018 年 2 月 推出了 首款产品,售价 2499 美元 的R1。 就在几年前,还没有企业市场可言–使用案例已经被讨论过了,但在教育终端用户了解无人机能为他们的业务做些什么方面仍有很大差距。到 2018 年,经验丰富的无人机操作员已经开始将这些问题联系起来;屋顶检查、土地测量和搜救都是早期的使用案例。事实上,商业意识已大大增强,以至于 Skydio 2 在 2016 年推出时,立即大受欢迎。

A Skydio X10D, Group 1 (Source: Flickr) Skydio X10D,第 1 组 (来源: Flickr) A Skydio X10D, Group 1 (Source: Flickr) Skydio X10D,第 1 组 (来源: Flickr) |

Just as this enterprise market was taking off, President Trump was getting increasingly “tough on China”. Suddenly, the idea that tensions could escalate and Chinese-made drones could become weapons of war became very real. In 2017, the U.S. Army grounded DJI drones following an internal memo citing cyber vulnerabilities. Three years later, the Department of the Interior grounded over 800 DJI drones used for conservation, and the Commerce Department added DJI to its “entity” list , restricting it from buying US-made technology or parts. No longer were drones merely fun consumer toys; they were now industrial tools that presented glaring national security vulnerabilities.

就在这一企业市场起飞的同时,特朗普总统对中国的 “强硬态度 “也越来越强烈。突然之间,紧张局势可能升级、中国制造的无人机可能成为战争武器的想法变得非常现实。2017 年,美国陆军 在一份内部备忘录中提到网络漏洞 ,禁飞了大疆无人机。 三年后,内政部 禁飞了 800 多架 用于保护 的大疆无人机 ,商务部 将大疆列入 “实体 “名单 ,限制其购买美国制造的技术或零部件。无人机不再仅仅是有趣的消费玩具,它们现在已成为工业工具,存在明显的国家安全漏洞。

With enterprise-level drones now deployed over cities and inspecting power plants, regulators grew increasingly concerned. Mesh radio, LTE connection, and machine learning further enhanced the efficacy of drones, creating unacceptable risks if they were under any form of control by a foreign adversary. It was these factors that made the gap of American-made drones painfully apparent. Something had to be done.

随着企业级无人机在城市上空的部署和对发电厂的检查,监管机构越来越担心。网状无线电、LTE 连接和机器学习进一步提高了无人机的效能,如果无人机受到外国对手任何形式的控制,就会产生不可接受的风险。正是这些因素使得美国制造的无人机的差距显而易见。必须有所作为。

Small Drones on the Battlefield

战场上的小型无人机

Just over twelve months after the DJI Phantom hit the market, Vladimir Putin annexed the Crimean Peninsula. By this time, a small community of tinkerers, pilots and developers had already sprang up around quadcopters — a minute but growing number of dedicated hobbyists knew how to, for example, add a special payload to a drone. Ukraine couldn’t purchase military equipment from foreign governments who were then still unwilling to provoke Russia, and had little money to spend.

就在大疆 Phantom 上市十二个多月后,弗拉基米尔-普京吞并了克里米亚半岛。此时,一个由工匠、飞行员和开发人员组成的小型社区已经围绕四旋翼无人机兴起–虽然人数不多,但越来越多的业余爱好者知道如何为无人机添加特殊载荷。乌克兰无法从外国政府购买军事装备,而外国政府当时仍不愿挑衅俄罗斯,也没有多少钱可花。

But cheap consumer-grade drones allowed Ukraine to leverage its wealth of technical talent to develop a homegrown military capability. In the spring of 2014, Ukrainian volunteers crowdfunded and sourced two Phantom 2s, one Skywalker X8, and one Oktopcopter, all commercial off-the-shelf drones, for the Ukrainian Army. Ukrainian battalion commander Natan Chazin founded the Aerozvidka Project , which by 2015 grew to a 20-man tactical unit of repurposed vans launching modified hobby drones.

但廉价的消费级无人机让乌克兰得以 利用其丰富的技术人才 ,发展本土军事能力。2014 年春,乌克兰志愿者 通过 众筹为乌克兰军队 购买了 两架 Phantom 2、一架 Skywalker X8 和一架 Oktopcopter,这些都是现成的商用无人机。乌克兰营长纳坦-查津(Natan Chazin )创立了 ” Aerozvidka 项目” ,到 2015 年,该项目已发展成为一支由 20 人组成的战术小分队,他们利用改装过的面包车发射改装过的业余无人机。

Artem Vyunnik, who had been building a consumer drone company at the time of the invasion, modified his prototype into the fixed-wing A1-CM “Fury” for military use, which was quickly adopted by the National Guard and the Armed Forces. Ukrainian drone pilots founded UKRSPECSYSTEMS to build new military drones from scratch out of commercial components, and quickly developed the PD-1 “People’s Drone”, also a fixed-wing system, capable of 6-hour flights. Companies rapidly iterated on combat drone models in conjunction with the armed forces, and produced around 30 different models of drone that were officially used by the Ukrainian army in the first three years of the war. In 2018, a U.S. Army National Guardsman advising the Ukrainian Delta Center told The Smithsonian that “In the last two years . . [The Ukrainians] have rapidly advanced from using dirigibles or balloons to do reconnaissance to building their own UAV systems . . . from zero.”

入侵发生时,Artem Vyunnik 正在建立一家消费级无人机公司,他将自己的原型机改装成了 用于军事用途 的 固定翼 A1-CM “狂怒”, 很快就被 国民警卫队 和武装部队 采用 。乌克兰无人机飞行员成立了 UKRSPECSYSTEMS公司 ,利用商业部件从零开始制造新型军用 无人机 , 并迅速开发出 PD-1型 “人民无人机”,这也是一种固定翼系统,可飞行 6 小时。公司与武装部队一起迅速迭代作战无人机型号,并生产了约 30 种不同型号的无人机,在战争的前三年被乌克兰军队正式使用。2018 年,一名为乌克兰三角洲中心提供咨询的美国陆军国民警卫队人员 告诉 《史密森尼》杂志 : “在过去两年里……(乌克兰人)从使用飞艇或气球进行侦察,迅速发展到从零开始制造自己的无人机系统……”。

Ukraine’s successful deployment of its drone industry after the 2022 invasion needs no introduction. Since then, armed forces across the globe have increasingly deployed small UAS for ISR (intelligence, surveillance and reconnaissance), munitions delivery, as well as electronic warfare. In August 2023 Department of Defense DoD Deputy Secretary of Defense Kathleen Hicks announced the Replicator Initiative , earmarking $1 billion to field thousands of low-cost unmanned systems for the U.S. military.

乌克兰在 2022 年入侵后成功部署了无人机产业,这一点无需多言。此后,全球各地的武装部队越来越多地部署小型无人机系统,用于 ISR(情报、监视和侦察)、弹药投送以及电子战。2023 年 8 月,国防部副部长凯瑟琳-希克斯(Kathleen Hicks)宣布了 ” 复制者计划 ” (Replicator Initiative) ,拨款 10 亿美元 为美军部署数千套低成本无人系统。

Simply put, small unmanned systems allow warfighters to complete missions too dangerous for human soldiers, at a dramatically lower cost. The U.S. Coast Guard, for example, calculated that it saved over $6.7 million in the last eighteen months by deploying small UAS instead of helicopters for vessel interception.

简而言之,小型无人系统能让作战人员以更低的成本完成对人类士兵来说过于危险的任务。例如,据美国海岸警卫队计算, 在过去 18 个月中, 通过部署小型无人机系统而不是直升机来拦截船只 ,节省了 670 多万美元 。

Building Drones in America

在美国制造无人机

Drones, like most technologies we interface with today, are as much software as they are hardware. Interestingly, it was 3DR that kickstarted the open-source drone software ecosystem that would go on to power many Western-made systems. FC Cube, flight controller hardware originally designed for the 3DR Solo, was commercialized and sold separately, becoming the world’s most reliable — besides DJI’s. Today, FC Cube powers drones like the Matternet M2 , a type-certified system that meets the most stringent standards set by the FAA for commercial use. 3DR also developed Ardupilot , an open-source autopilot software suite supporting a broad range of unmanned systems. Originally developed for internal use, Ardupilot has since ballooned into an open-source ecosystem with over 20,000 developers.

无人机与我们今天接触的大多数技术一样,既是软件也是硬件。有趣的是,正是 3DR 开启了开源无人机软件生态系统,为许多西方制造的系统提供动力。FC Cube 是最初为 3DR Solo 设计的飞行控制器硬件,后来被商业化并单独销售,成为世界上除大疆之外最可靠的飞行控制器。如今,FC Cube 为 Matternet M2 等无人机提供动力 ,Matternet M2 是经过型号认证的系统,符合 FAA 为商业用途设定的最严格标准。3DR 还开发了 Ardupilot ,这是一款开源自动驾驶软件套件,支持多种无人驾驶系统。 Ardupilot 最初是为内部使用而开发的, 现已发展成为一个拥有 20,000 多名开发人员的开源生态系统。

Of course, software alone would not cut it. Competing with China means also building hardware. In 2019, the United States National Defense Authorization Act (NDAA) for FY2020 — the annual bill funding our military — first included language banning the use of drones with electronic components made in China (today, also expanded to Russia, Iran, and North Korea.) Consequently, the Defense Innovation Unit (DIU) created the Blue UAS list, a shortlist of drones with fully verified secure supply chains.

当然,仅靠软件是不够的。与中国竞争意味着还要打造硬件。2019 年,美国《2020 财年国防授权法案》(NDAA)–为我们的军队提供资金的年度法案–首次纳入了 禁止使用 带有中国制造电子元件 的无人机的 措辞 (如今还扩大到俄罗斯、伊朗和朝鲜) 。

While Blue UAS and NDAA compliance is legally only relevant for Department of Defense procurement, many other areas of government have now chosen to follow these guidelines — but not all of them. Between 2010-2022, over 85% of drones purchased by state agencies were Chinese-made. Below is a table of various levels of state regulation as of July 2024.

虽然从法律上讲,”蓝色无人机系统 “和 NDAA 合规性仅适用于国防部的采购,但许多其他政府领域现在也选择遵循这些准则,但并非所有政府领域都是如此。2010-2022 年间, 州政府机构采购的 无人机有 85% 以上 是中国制造。以下是截至 2024 年 7 月的各州监管水平表。

While it might seem obvious to outright ban Chinese-made drones in American skies — we wouldn’t allow Chinese planes flying over us — such heavy-handed regulation has consequences, too. The reality is that DJI builds the best drones, particularly when it comes to small-business applications. Today, no American-made system is as affordable and reliable, so it’s no wonder that many affected parties have loudly opposed an immediate ban. Moreover, DJI is no stranger to lawmakers — consider that they’ve out-lobbied Skydio nearly 3-to-1, spending $1.6 million just last year.

直接禁止中国制造的无人机在美国上空飞行似乎是显而易见的– 我们不允许中国飞机在我们上空飞行 – -但这种高压监管也会带来后果。现实情况是,大疆制造了最好的无人机,尤其是在小型企业应用方面。如今,没有哪款美国制造的系统能像大疆一样经济实惠、性能可靠,难怪许多受影响的各方大声反对立即颁布禁令。此外,大疆对立法者来说并不陌生–想想看 , 仅去年一年, 他们 就花费了 160 万美元,比 Skydio 多出近 3 倍 。

The Future of American Drones

美国无人机的未来

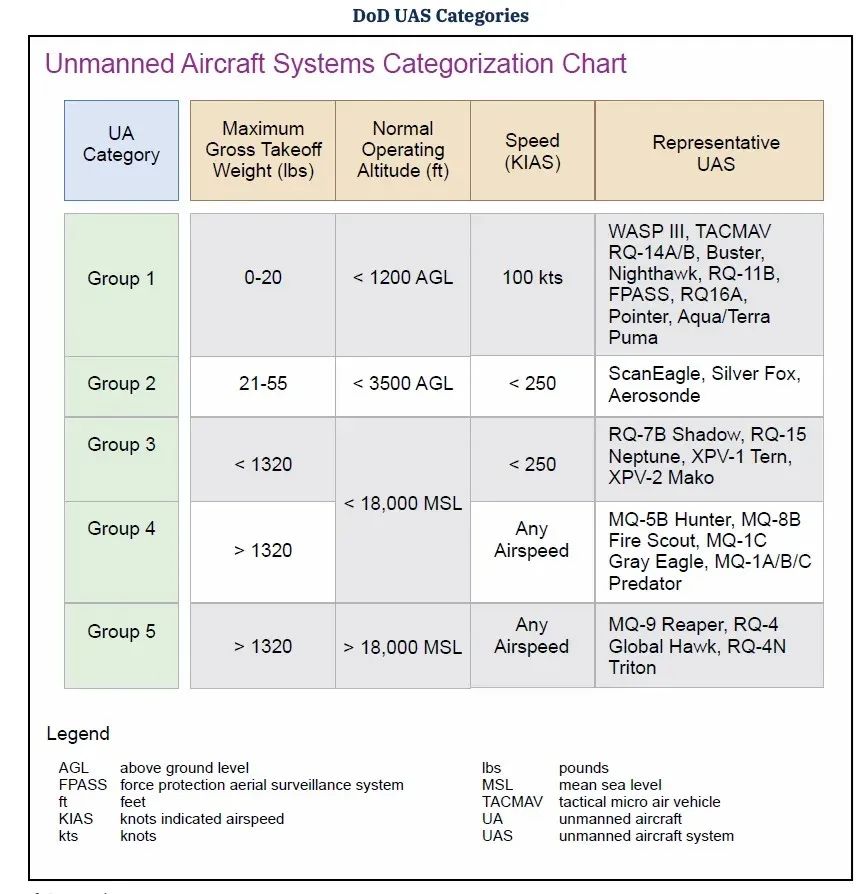

Although the Countering CCP Drones Act excises the national security threat, it won’t catalyze a domestic industry that rivals DJI out of thin air. Truthfully, it will be challenging to compete with DJI, but with better technology, the United States can win. Where winning technologies coalesce will likely be different according to use case. At a high-level, drones are segmented by “ group ” according to their size and capability by the U.S. military :

尽管《法案》消除了国家安全威胁,但它并不能凭空催生一个可与大疆匹敌的国内产业。实事求是地说,与大疆竞争将是一项挑战,但 只要有更好的技术,美国就能获胜。 根据不同的使用情况,制胜技术的凝聚点可能会有所不同。在高层次上, 美国军方 根据 无人机 的规模和能力对其 进行 ” 分组 ” :

Source: FAA 来源:美国联邦航空局 美国联邦航空局 Source: FAA 来源:美国联邦航空局 美国联邦航空局 |

Broadly speaking, drones range from small, cheap Group 1 systems (like military FPV kamikaze drones or commercial indoor inspection drones) to large, expensive Group 5 systems (such as the $30 million MQ-9 Reaper for high-altitude, long-endurance missions).

从广义上讲,无人机既包括小型、廉价的第 1 组系统(如军用 FPV 神风特攻队无人机或商用室内巡查无人机),也包括大型、昂贵的第 5 组系统(如用于执行高空长航时任务、造价 3000 万美元的 MQ-9 Reaper)。

What matters most is not the price tag, but the cost per mission — how many missions can it be expected to fly before it is jammed or shot out of the sky ? A $2,000 drone which flies one kamikaze mission effectively costs the same as a $20,000 drone which can be expected to survive 10 missions. Second is capability — can the drone support high-resolution sensor payloads? Can it deliver munitions? Does it have obstacle avoidance? As drones are deployed in a wider variety of applications, different size/cost/capability combinations own different use cases.

最重要的不是标价,而是每次任务的成本– 在被干扰或被击落之前,预计它能执行多少次任务 ?一架价值 2000 美元的无人机执行一次 “神风特攻队 “任务的成本,实际上与一架价值 2 万美元的无人机执行 10 次任务的成本相同。其次是能力–无人机能否支持高分辨率传感器有效载荷?能否投放弹药?是否具有避障功能?随着无人机的应用越来越广泛,不同的尺寸/成本/能力组合拥有不同的使用案例。

We will not accomplish a DJI ban by forcing American operators to use subpar systems. Pilots won’t stand for the ban until they have a viable alternative. That can only follow the development of a robust American drone manufacturing base. So how do we win? As the war in Ukraine has gruesomely illustrated, attritable systems are a key capability on the modern battlefield, and the United States should absolutely build up its own Group 1 companies. But the truth that inspired Made in China 2025 still holds — China is far better at making cheap products. We will likely not beat DJI purely on labor and component cost.

我们不会通过强迫美国操作员使用次品系统来实现对大疆的禁令。除非有可行的替代方案,否则飞行员不会支持禁令。这只能在美国无人机制造基地发展壮大之后才能实现。那么,我们该如何取胜呢?正如乌克兰战争惨烈地表明,可减员系统是现代战场的关键能力,美国绝对应该建立自己的第一集团军。但是,激励《中国制造 2025》的真理依然存在–中国更擅长制造廉价产品。单纯依靠劳动力和零部件成本,我们很可能无法击败大疆。

America has the advantage in advanced capabilities. The United States drone industry has succeeded in fostering a collaborative ecosystem of open-source software and hardware developers; companies like Aerodome

, who builds drone-as-first responder software on top of off-the-shelf drones; and DroneDeploy , which supports reality capture. By acting as a platform and not competing with their customers, American drone companies can achieve the scale needed to drive down costs and compete with DJI. In the age of AI, a single low-cost drone with high-resolution sensors and a GPU can run a variety of software applications that can make it significantly more capable than a comparable Chinese system.

美国拥有先进的能力优势。美国无人机行业成功地培育了一个由开源软件和硬件开发商组成的合作生态系统; Aerodome 等公司 在现成的无人机基础上构建了无人机作为第一响应者的软件; DroneDeploy 支持现实捕捉。美国无人机公司通过作为一个平台,不与客户竞争,可以实现降低成本和与大疆竞争所需的规模。在人工智能时代,一架配备高分辨率传感器和 GPU 的低成本无人机可以运行各种软件应用程序,使其能力大大超过同类中国系统。